In today’s global marketplace, exporting goods to international markets offers immense opportunities for businesses. However, it also comes with a host of risks that can potentially lead to significant financial losses. This is where export insurance, or export credit insurance, comes into play. In this comprehensive guide, we will delve into what export insurance is, how it works, its essential parameters, the risks it mitigates, and why it has become indispensable for exporters in the current economic climate.

What is Export Insurance?

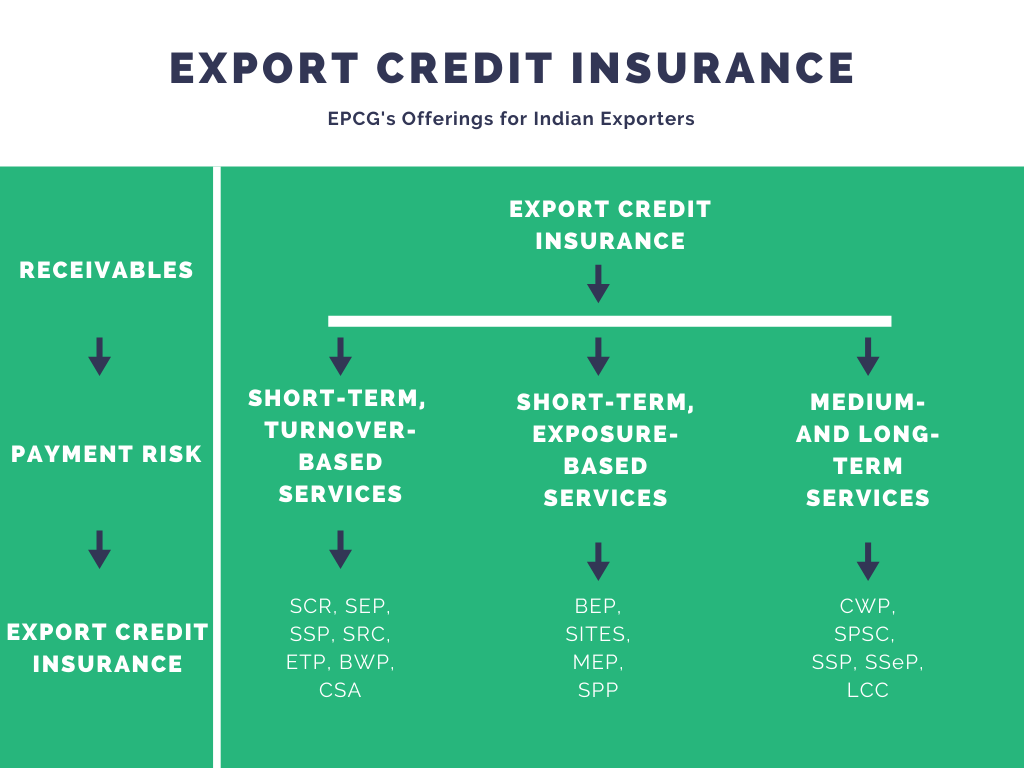

Export insurance, also known as export credit insurance, is a financial product that protects exporters from the risk of non-payment by foreign buyers. It is designed to safeguard businesses against the various uncertainties associated with international trade, such as political instability, currency fluctuations, and the insolvency of buyers. By securing export insurance, businesses can confidently extend credit to foreign buyers, knowing that they will be compensated if the buyer defaults on payment.

For more detailed information on export insurance, visit Allianz Trade

How Does Export Insurance Work?

Export insurance typically covers a range of risks, including commercial risks (like buyer insolvency or protracted default) and political risks (such as war, expropriation, or currency inconvertibility). The coverage provided by export insurance can vary based on the policy and the insurer, but it generally follows these steps:

- Application: The exporter applies for an export insurance policy from an insurance provider.

- Assessment: The insurer assesses the creditworthiness of the foreign buyer and the risks associated with the transaction.

- Policy Issuance: Once approved, the insurer issues a policy outlining the terms, conditions, and coverage limits.

- Claim: If the foreign buyer defaults or a covered political event occurs, the exporter files a claim with the insurer.

- Compensation: The insurer compensates the exporter for the insured loss, typically covering a significant percentage of the invoice value.

To learn more about the workings of export insurance, check out Trade.gov.

Key Parameters of Export Insurance

To effectively utilize export insurance, exporters must understand its key parameters:

- Coverage Limits: The maximum amount that the insurer will pay in the event of a claim.

- Premiums: The cost of the insurance, which can vary based on the risk profile of the buyer and the country.

- Deductibles: The portion of the loss that the exporter must bear before the insurance coverage kicks in.

- Exclusions: Specific situations or risks that are not covered by the policy.

- Duration: The period during which the insurance policy is active.

For a comprehensive understanding of these parameters, visit Coface.

Why Export Insurance is Necessary Today

In the current global economic environment, several factors make export insurance more crucial than ever:

1. Increased Global Trade Uncertainties

Political instability, trade wars, and economic sanctions have become more frequent, creating unpredictable trading environments. Export insurance provides a safety net against such uncertainties, allowing exporters to navigate these challenges with confidence.

2. Economic Volatility

Fluctuating exchange rates and economic instability in various countries can impact the ability of buyers to pay for goods. Export insurance mitigates the risk of non-payment due to economic factors beyond the exporter’s control.

3. Enhanced Market Opportunities

Export insurance enables businesses to explore new and potentially high-risk markets by providing a financial safety net. This can lead to increased sales and market expansion without the fear of incurring significant losses.

4. Buyer Insolvency Risks

The financial health of foreign buyers can be difficult to assess accurately. Export insurance covers the risk of buyer insolvency, ensuring that exporters are protected if a buyer goes bankrupt.

Risks Mitigated by Export Insurance

Exporting goods to foreign markets involves several risks, which can be broadly categorized into commercial and political risks:

Commercial Risks

Political Risks

- Buyer Insolvency: If the foreign buyer goes bankrupt or becomes insolvent, the exporter may not receive payment for shipped goods.

- Protracted Default: When the buyer delays payment beyond the agreed terms, leading to cash flow issues for the exporter.

- Non-Acceptance of Goods: Situations where the buyer refuses to accept the goods, potentially due to changes in demand or disputes.

- War and Civil Disturbance: Political unrest, war, or civil disturbances in the buyer’s country can disrupt trade and payment.

- Expropriation: Government actions such as expropriation or nationalization of assets can prevent payment.

- Currency Inconvertibility: Restrictions on currency exchange or transfer can hinder the buyer’s ability to pay in the exporter’s currency.

For detailed discussions on the risks mitigated by export insurance, visit ScienceDirect.

Pros and Cons of Export Insurance

While export insurance offers significant benefits, it also comes with some drawbacks. Understanding both the pros and cons is essential for making an informed decision.

Pros

Cons

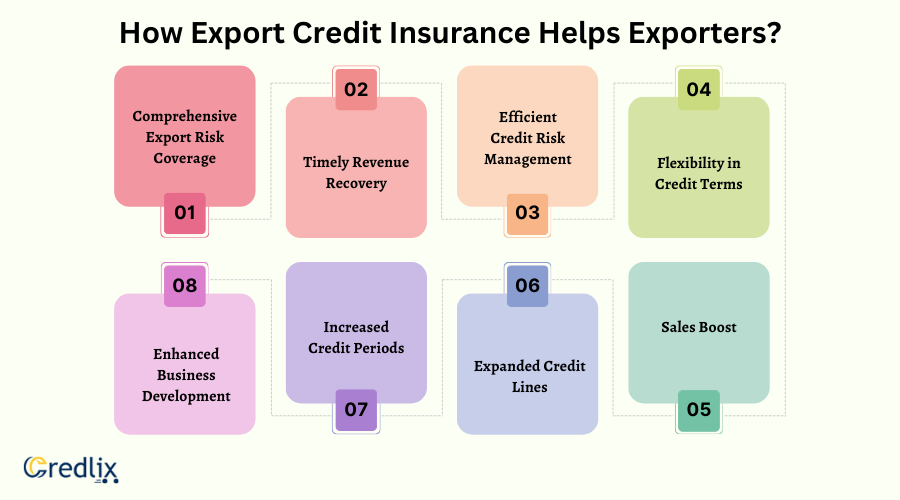

- Risk Mitigation: Provides protection against a wide range of commercial and political risks.

- Market Expansion: Encourages exporters to explore new and high-risk markets with confidence.

- Improved Cash Flow: Ensures timely payments, enhancing the exporter’s cash flow and financial stability.

- Credit Management: Helps in managing credit risks by evaluating the creditworthiness of foreign buyers.

- Competitive Advantage: Allows exporters to offer competitive credit terms to buyers, potentially increasing sales.

- Cost: Premiums for export insurance can be high, particularly for high-risk markets and buyers.

- Exclusions and Limitations: Certain risks may not be covered, and there may be exclusions that limit the scope of the insurance.

- Complexity: Understanding the terms and conditions of export insurance policies can be complex and time-consuming.

- Administrative Burden: The process of applying for insurance, managing policies, and filing claims can add to the administrative workload.

For further information on the pros and cons of export insurance, check out Credlix.

Conclusion: The Strategic Importance of Export Insurance

Export insurance is a vital tool for businesses engaged in international trade. It offers a robust mechanism to protect against the myriad risks associated with exporting, from buyer insolvency to political instability. By mitigating these risks, export insurance not only secures payments but also enables businesses to confidently explore and expand into new markets.

In today’s volatile global economy, the importance of export insurance cannot be overstated. It provides a safety net that empowers exporters to grow their businesses while safeguarding their financial interests. As the international trade landscape continues to evolve, leveraging export insurance will remain a strategic imperative for exporters worldwide.